S5 E1 : ₹ 100 CHALLENGE : BUILD A PORTFOLIO IN ₹ 100.

👋 Welcome to your first challenge!

Let’s say you have just ₹100 in your hand. No crores. No lakhs.

Just one hundred rupees.

Now the mission is simple:

👉 Build a mini stock portfolio — as if you're managing a tiny mutual fund.

🎯 Why Do This?

Because if you can build a solid plan with ₹100…

You’ll definitely make better decisions with ₹1,000 or ₹10,000 later.

This challenge is not about big returns.

It’s about learning how to think like an investor.

🪙 Step 1: Understand Your ₹100 Budget

Let’s break your ₹100 into simple parts:

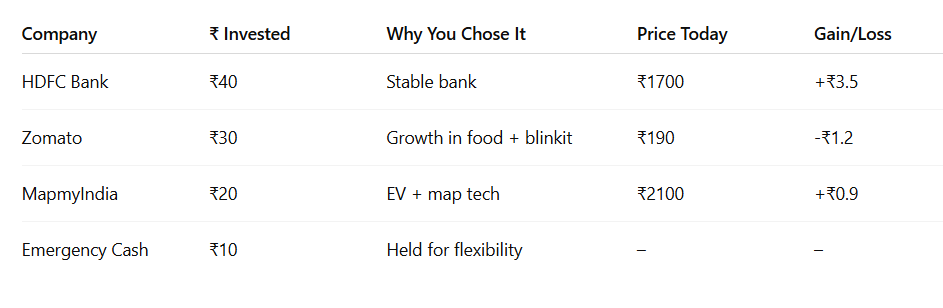

-

₹40 → For Safe & Trusted Stocks (e.g., large, stable companies)

-

₹30 → For Growth Stocks (companies with high potential)

-

₹20 → For New Ideas or Trends (emerging sectors or innovations)

-

₹10 → Set aside as Emergency Cash (to stay flexible)

🔹 You’re creating your own mini mutual fund.

🔹 Just like how big fund managers diversify.

🧠 Step 2: Research & Pick Real Stocks

Let’s use real examples. Open your Groww / Zerodha app and explore.

Here’s how you might think:

✅ Safe + Trusted (₹40)

Pick a stable and trusted company — something that’s been growing steadily.

Examples:

-

HDFC Bank

-

Infosys

-

Tata Consultancy Services (TCS)

These are like “backbone stocks”. They don’t jump fast, but they’re strong.

🚀 Growth Focus (₹30)

Look for companies with potential to grow fast in the future.

Examples:

-

Zomato (online food & quick commerce)

-

Tata Elxsi (design & tech)

-

Nykaa (online beauty + lifestyle)

These are bets on future trends.

🌱 New Idea / Trend (₹20)

This is your “smart risk” bucket.

Maybe a new-age startup or trending sector — EV, AI, space, renewable, etc.

Examples:

-

MapmyIndia (EV navigation, India maps)

-

KPIT Tech (Auto software)

-

IRCTC (Online rail booking monopoly)

This is where magic can happen — or might not. That's the risk.

💼 Emergency Cash (₹10)

You don’t invest this. You keep it aside.

Why? In case one of your picks crashes, and you need to rebalance or switch.

📋 Step 3: Track & Review Weekly

Create a Google Sheet or notebook:

Every week, update it. Add your thoughts.

📢 Bonus Tip: Use Fractional Shares or Smallcase

Some platforms allow you to invest tiny amounts into multiple stocks using:

-

Fractional shares (internationally)

-

Smallcases (curated baskets in India)

🏁 Final Words

This challenge is not about profits.

It’s about building your mindset and muscle as an investor.

✅ You learned how to:

-

Split money smartly

-

Think in buckets (safe, growth, risky)

-

Build confidence to manage money

Next time you have ₹1,000 or ₹10,000…

You’ll already know how to think like a fund manager.

🔖 Assignment:

Open your stock app or website.

Pick 3 stocks today for this ₹100 challenge.

Write down why you picked each one.

That’s your first step to becoming a serious investor 💼📈