S1 E5 : HOW SHARE PRICES MOVE (DEMAND & SUPPLY LOGIC)

🤔 You Might’ve Noticed:

- Tata Motors was ₹720 yesterday, now it’s ₹738

- Zomato was ₹92, now it’s ₹89

- Prices seem to change every minute!

And the big question is:

“Who changes these prices?”

“Is it random? Is someone deciding it?”

Nope. No one sits and controls prices.

It’s all about one simple rule:

Price goes up when more people want to buy.

Price goes down when more people want to sell.

Let’s break it down — in the simplest way possible.

🍅 Real-Life Example: Tomato Market

At your local market:

- If everyone is buying tomatoes, but there aren’t many left → price goes up

- If no one is buying tomatoes, and the market is full → price goes down

That’s basic demand and supply.

🟢 More buyers = demand ↑ = price goes up

🔴 More sellers = supply ↑ = price goes down

The stock market works exactly the same way — but for shares.

💼 Example: Tata Motors Share

Let’s say:

- Many people hear Tata is launching a new electric car 🚗

- Everyone gets excited and wants to buy Tata shares

- Suddenly, 1 lakh people want to buy it

- But only 40,000 people are selling

👉 This causes the price to go up.

Now imagine:

- Bad news comes (e.g., lower profits this quarter)

- People get scared and start selling

- More sellers, fewer buyers

👉 Now price starts going down.

🧁 Simple Analogy: Cupcake Auction

You bake 10 cupcakes and take them to college.

50 people want to buy them.

What happens?

- One person says, “I’ll pay ₹20”

- Another says, “I’ll pay ₹22”

- Another says, “₹25!”

- Price keeps going up

But if no one wants them?

You’ll drop the price to ₹15… then ₹10… maybe ₹5 — just to sell them.

That’s how share prices change — every second.

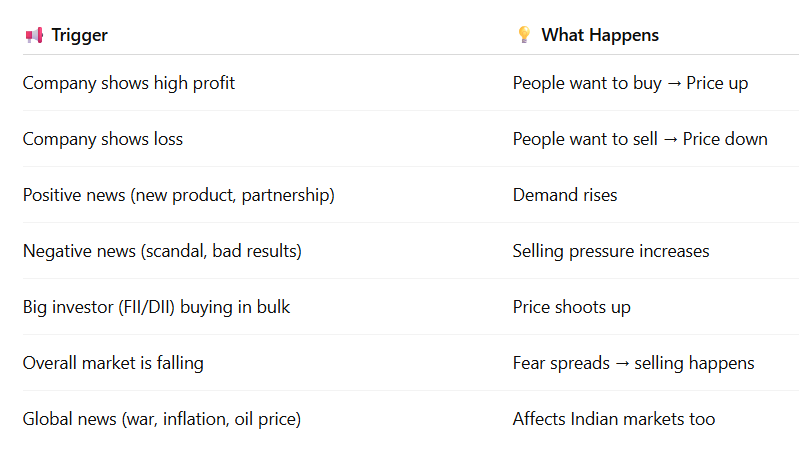

📊 Why Does Demand/Supply Change?

Here are common reasons share prices move:

-

Company reports high profits

→ Investors feel confident. More people start buying. Result? Price goes up.

-

Company shows a loss

→ Doubts and fear creep in. People begin to sell. Result? Price drops.

-

Positive news like a new product launch or big partnership

→ Hype builds up. More demand for the stock. Price rises.

-

Negative news like a scandal or poor results

→ Panic kicks in. Investors rush to exit. Selling increases, price falls.

-

When big investors (like FIIs or DIIs) buy in bulk

→ Everyone notices. It’s like a signal. Others follow. Price shoots up.

-

If the overall market is falling

→ Even good stocks get sold out of fear. Selling pressure builds.

-

Global events like war, oil price hikes, or inflation

→ Indian markets also react. Prices swing based on global mood.

📉 Example: Zomato Drops After Listing

Zomato IPO price was ₹76

- It shot up to ₹120 in excitement

- Later dropped to ₹50 when profits were low and big investors sold

It wasn’t a mystery — it was just emotions + news + supply/demand.

🧠 Recap in 6 Quick Points

✅ Share prices change every second — not fixed

✅ More buyers = price up 🔼

✅ More sellers = price down 🔽

✅ Demand/supply depends on news, emotions, and results

✅ No single person controls the price — the market does

✅ It’s just like a vegetable or fruit market — but for shares

✨ Final Thought:

The stock market isn’t magic or manipulation.

It’s just millions of people reacting to news, fear, greed, and opportunity — and price adjusts automatically.

The better you understand this, the smarter your decisions become.