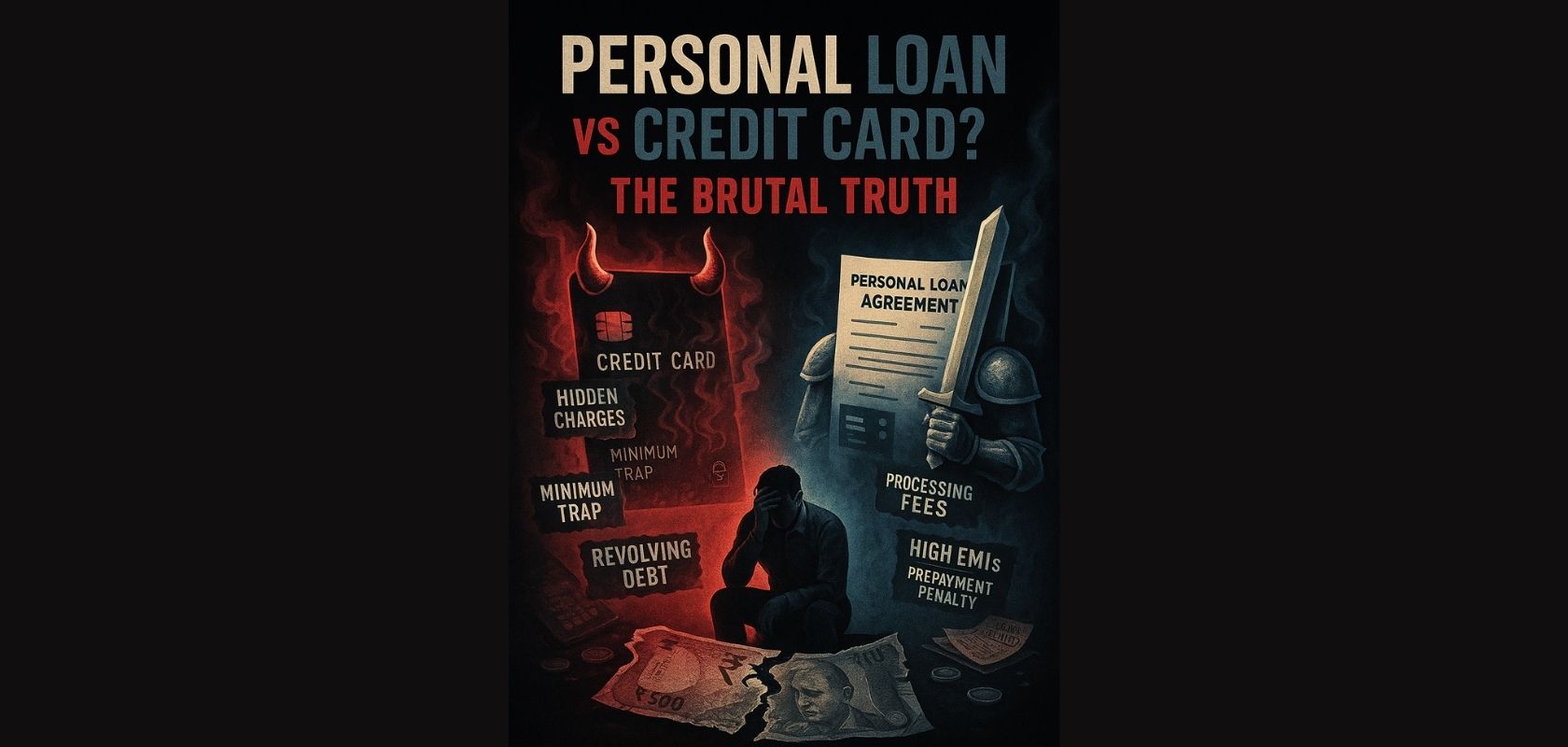

Personal Loan or Credit Card? The Brutal Truth

You’re short on cash. You need to pay something big.

You’re stuck between two tempting options:

Swipe your credit card or apply for a personal loan.

Both offer quick money.

Both come with hidden traps.

So which one is right?

Here’s the brutal truth: one can quietly drain you. The other can save you — only if you use it right.

💳 Credit Card: Quick Relief, Fast Regret

Pros:

-

Instant availability (no paperwork)

-

Interest-free period (up to 45 days)

-

Great for small, short-term expenses

-

Earn rewards, cashback, or miles

Cons:

-

Insanely high interest (30–42% annually) if you miss full payment

-

Paying the minimum due = falling into a long-term debt trap

-

Easy to overspend because it doesn’t “feel” like money

-

Revolving credit = never-ending cycle

Verdict:

Great for emergency use — only if you can repay in full before the due date.

Terrible for big purchases or long-term borrowing.

🏦 Personal Loan: Bigger Debt, More Control

Pros:

-

Lower interest compared to credit cards (10–24% annually)

-

Fixed EMIs — easy to plan and budget

-

Larger amounts available (₹50,000 – ₹25 lakh)

-

Good for debt consolidation or planned purchases

Cons:

-

Longer approval process

-

Processing fees (1–3%)

-

Missed EMIs hit your CIBIL score hard

-

You can’t reuse the limit like a credit card

Verdict:

Best for large, planned expenses (medical, education, debt clearing) where you need structure and discipline.

⚔️ Which One Hurts More If You Misuse It?

1. Late Payment

Credit Card: 35–42% interest + late fees

Personal Loan: 1.5–2% penalty per month

2. Overuse

Credit Card: Can lead to a debt spiral + lower CIBIL score

Personal Loan: Creates EMI pressure + higher default risk

3. Paying Minimum Only

Credit Card: Traps you in debt for years

Personal Loan: Not applicable

4. Impulsive Borrowing

Credit Card: Very likely

Personal Loan: Less likely (requires effort to apply)

Credit cards punish bad habits harder.

Personal loans punish bad planning.

🧠 So, Which One Should You Choose?

Ask yourself:

✅ Can I repay in full within 30–45 days? → Use credit card.

❌ Need more time? Need ₹50k–₹5L? → Go for a personal loan.

❌ Already in debt? → Consider a low-interest personal loan to pay off high-interest credit cards.

❌ Don’t trust your spending habits? → Avoid both. Use cash/debit.

💡 Pro Tip: Never Take a Loan or Swipe a Card to Impress Anyone

You’re not buying love. You’re renting stress.

🧠 Final Word: Easy Money Is the Most Expensive Kind

Both credit cards and personal loans can help you or haunt you.

They’re not enemies — but if you use them wrong, they’ll treat you like one.

Be intentional. Borrow smart. Pay on time.

That’s the only brutal truth you need to win the money game.